Private Placement: A private placement is a capital raising event that involves the sale of securities to a relatively small number of select investors. Investors involved in private placements.. The placing price. The placing price will usually be at a discount to the prevailing price. This is because investors in the placing will want cheaper shares. Rarely is a placing done at a premium because then the investors could just buy in the market for cheaper. A good placing is done at a relatively modest discount.

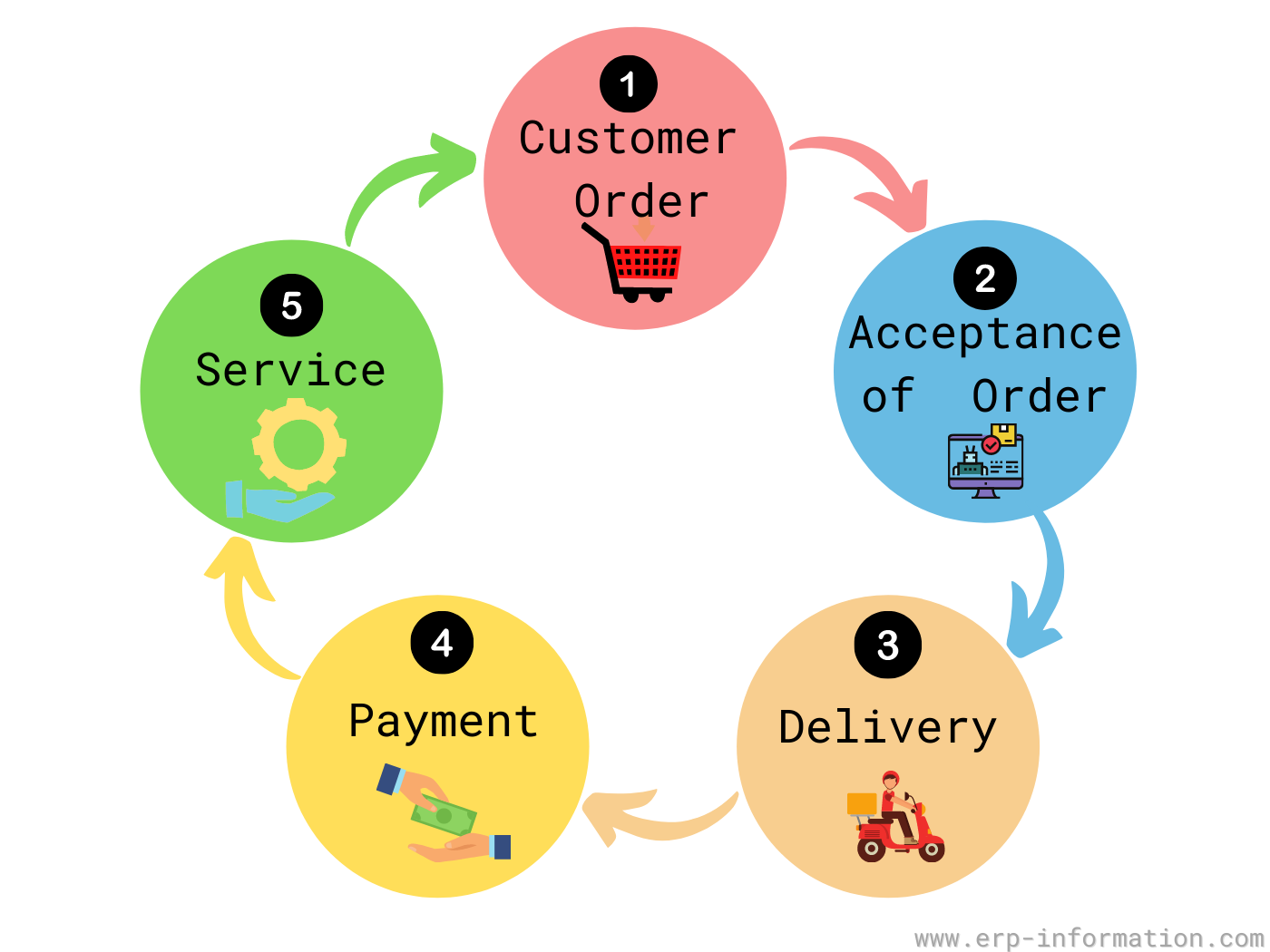

What is a Customer Order? Processing & Management

Place Strategy in Marketing Mix Management Weekly

Shared Value Creating Value for Society Whilst Making Profits Strathmore University Business

:max_bytes(150000):strip_icc()/SHAREBUYBACKFINALJPEGII-e9213e5fe3a9435b9d0cc4d33d33a591.jpg)

Why Would a Company Buy Back Its Own Shares?

What is Share in Stock market Why companies Issue Shares to Public (IPO) Episode 9 YouTube

7 Steps of Buying And Selling Process PowerPoint

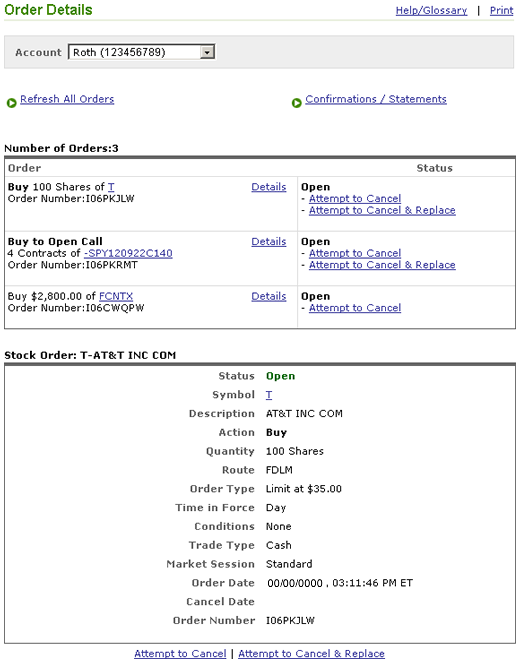

Trading FAQs Placing Orders Fidelity

😍 Difference between equity share and preference share and debenture. What is the difference

Smiling group of diverse colleagues working together in an office BARE International

What is a share? Definition and Explanation of what shares are in business Investments

Pin by Parul Soni on share market tips Share market, Tips, Marketing

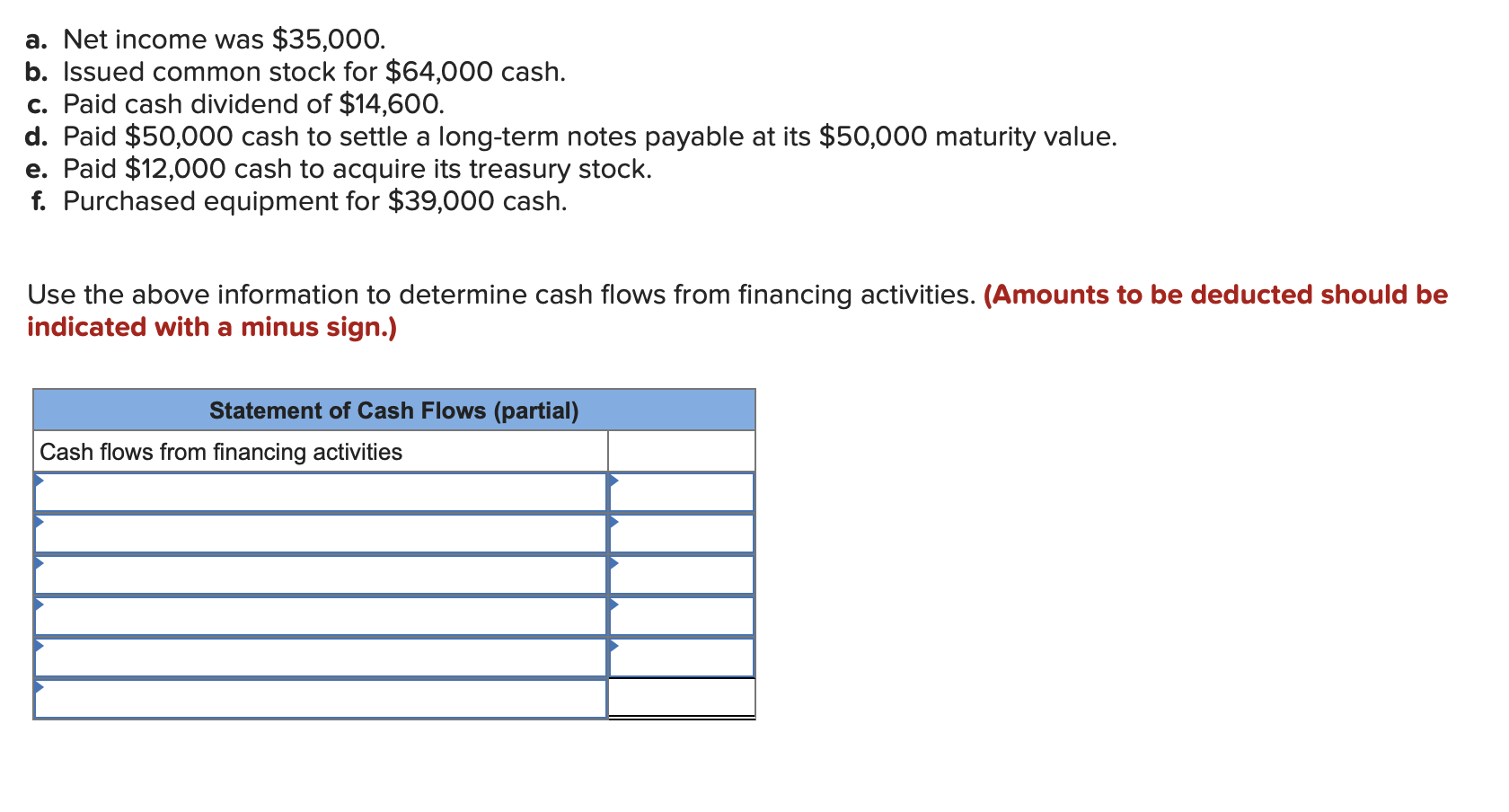

Solved Indicate where each item would appear on a statement

TRADING PROCESS FLOW CHART! Stock trading strategies, Day trading, Stock trading learning

Letter Of Order Samples Free Printable Word Pdf Formats Templates My XXX Hot Girl

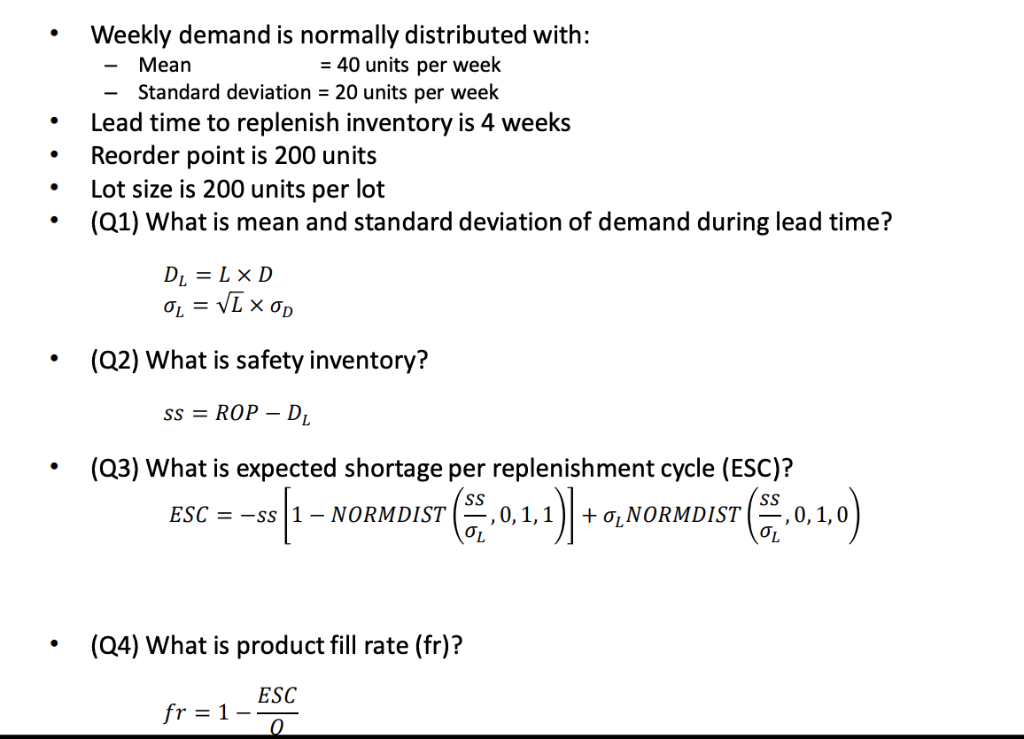

Solved .Weekly demand is normally distributed with Mean =

Firms Present Market Share Place And Ppt Powerpoint Presentation Pictures Samples Presentation

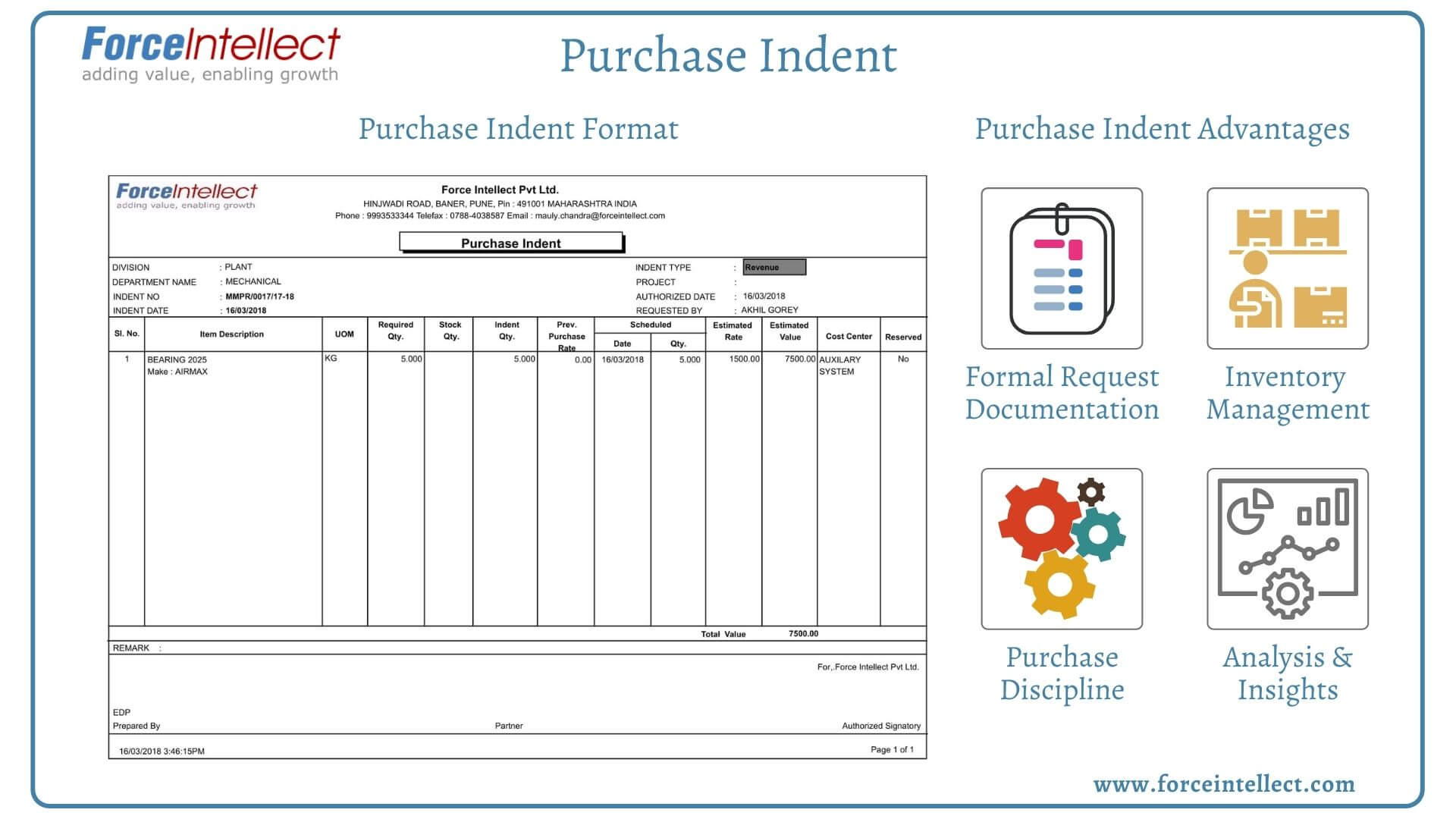

What is a Purchase Indent? Purchase Indent Format

Solved Your firm uses a continuous review system (i.e.,

What is preopen Market , After Market Order and Short Delivery YouTube

What Is a Purchase Order & How Does It Work?

A private placement refers to the sale of securities to specific investors rather than to the open market. In other words, a company will sell shares or bonds to pre-defined investors to raise capital for a specific purpose. For companies, a private placement is an alternative method for raising capital instead of having to sell shares to the.. A placing is an alternative way of raising secondary capital. Placings are usually used for smaller fund raisings as they are simpler and cheaper with less administration required than for a rights issue. No prospectus is required if less than 10% of the total equity value is raised and a restricted prospectus for larger amounts.