The $450k after tax calculation includes certain defaults to provide a standard tax calculation, for example the State of Texas is used for calculating state taxes due.. Medicare Tax Rate: 1.45%: Additional Medicare Tax Rate (on earnings over $ 200,000.00) 0.9%: Medicare Due: $ 8,775.00: State Tax Due: $ 0.00: Local Tax Due Due: $ 0.00: Take.. In the year 2024, in the United States, $49,000 a year gross salary, after-tax, is $41,131 annual, $3,115 monthly, $716.45 weekly, $143.29 daily, and $17.91 hourly gross based on the information provided in the calculator above. Check the table below for a breakdown of $49,000 a year after tax in the United States. If you're interested in.

Life of Tax How Much Tax is Paid Over a Lifetime Self.

40 increase in pay, 7k after taxes, looks good but currently I'm only posting memes since there

after doing my own taxes

How Much Did Jane Earn Before Taxes? New

![How much is 58,240 a year after taxes (filing single) [2023]? Smart Personal Finance How much is 58,240 a year after taxes (filing single) [2023]? Smart Personal Finance](https://smartpersonalfinance.info/wp-content/uploads/2022/08/after-tax-income-on-58240-dollars-sm-2-1024x768.png)

How much is 58,240 a year after taxes (filing single) [2023]? Smart Personal Finance

![215K Dollars Salary After Taxes in Nevada (single) [2023]? Smart Personal Finance 215K Dollars Salary After Taxes in Nevada (single) [2023]? Smart Personal Finance](https://smartpersonalfinance.info/wp-content/uploads/2022/09/nv-215000-after-taxes-sm-1024x768.png)

215K Dollars Salary After Taxes in Nevada (single) [2023]? Smart Personal Finance

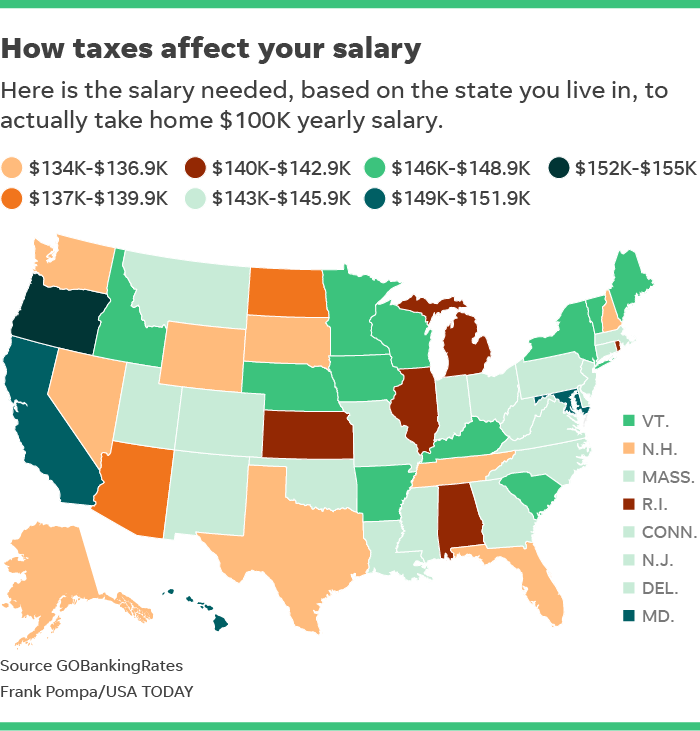

taxes How much you really need to earn to take home 100,000

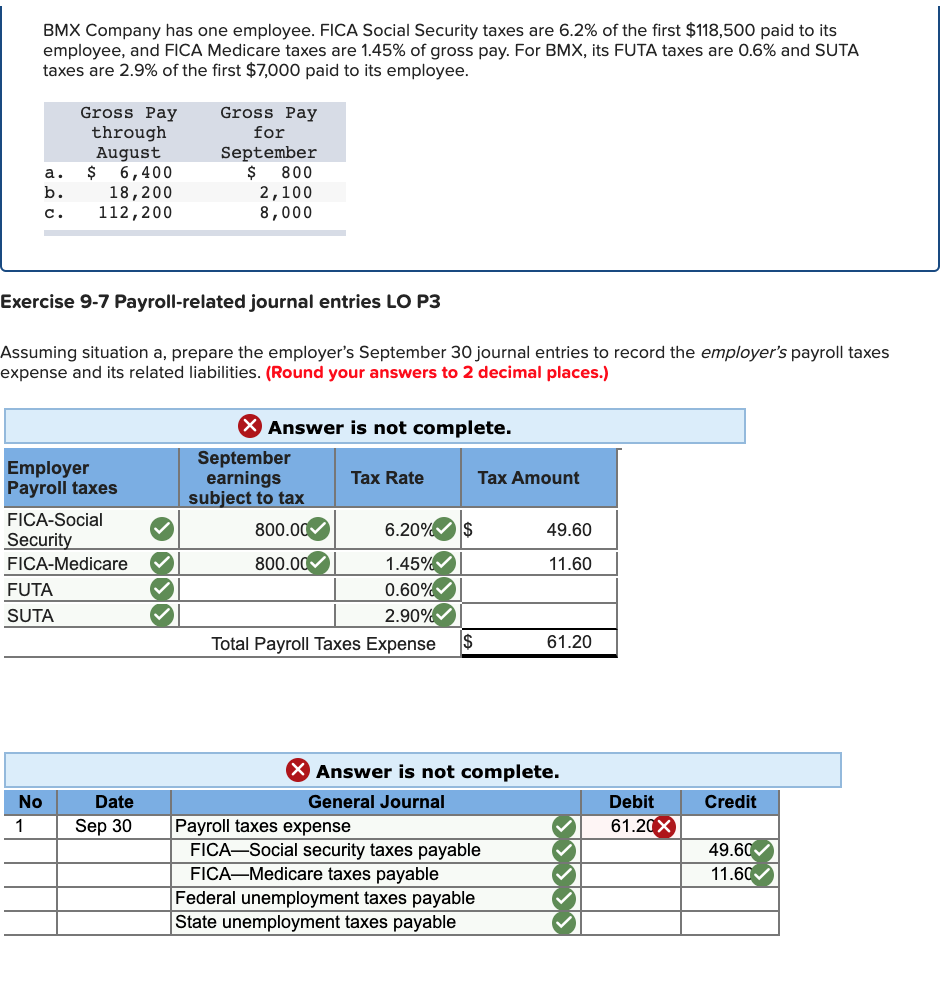

Solved BMX Company has one employee. FICA Social Security

How Much Tax Will I Pay On 50000 Uk Tax Walls

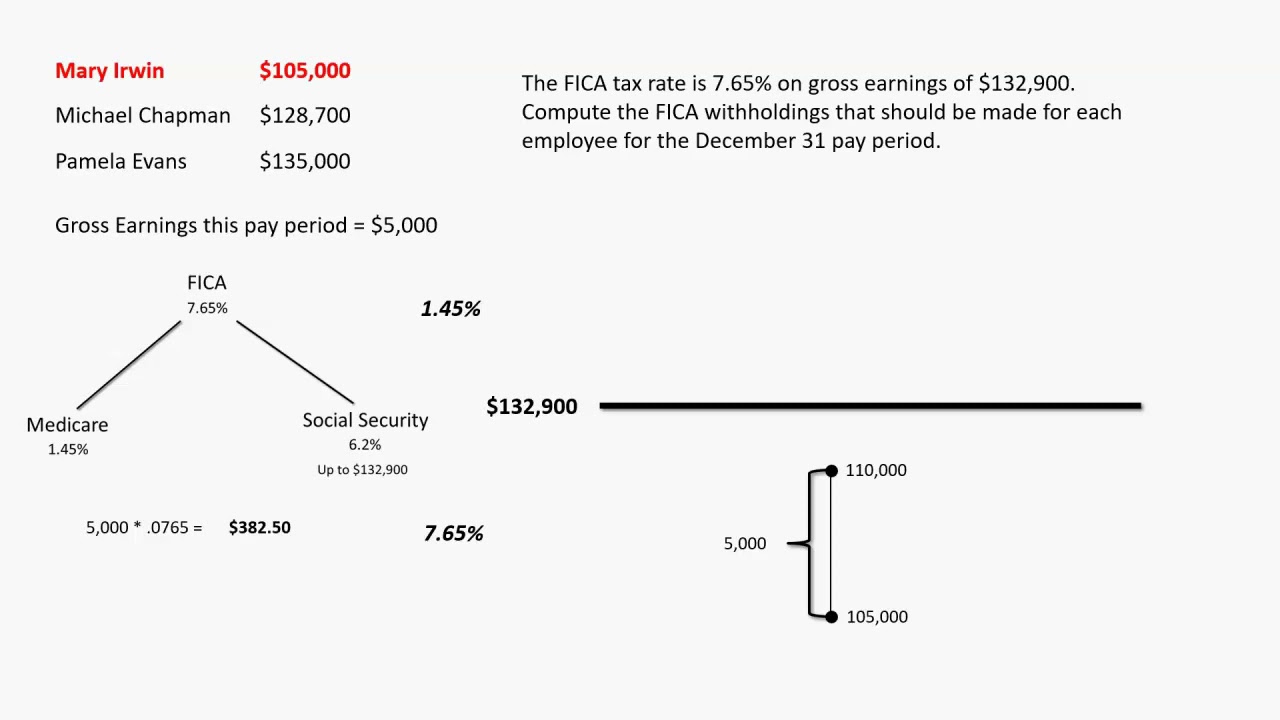

Calculating FICA Taxes YouTube

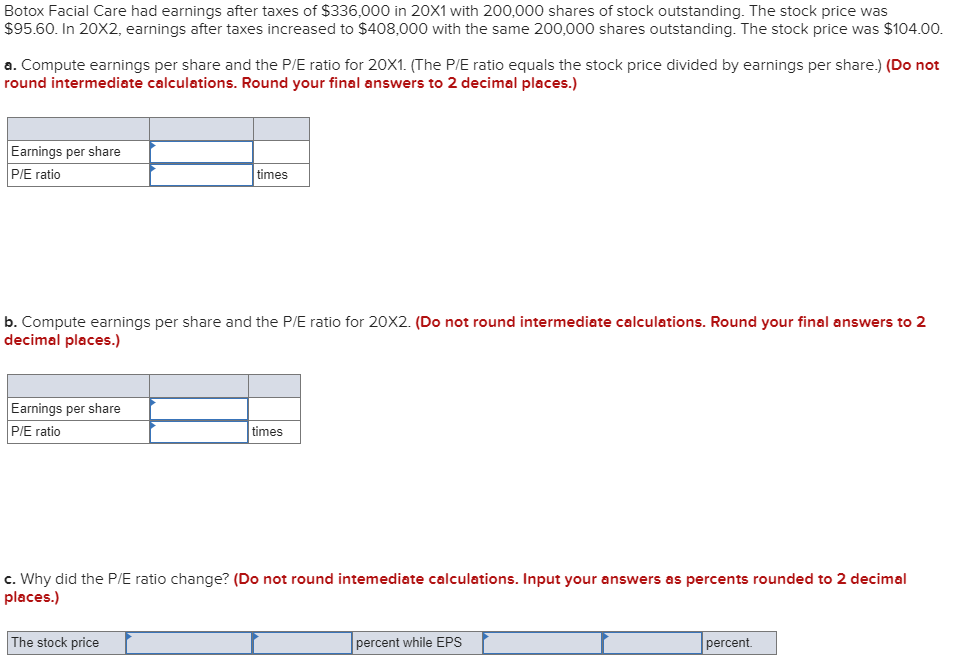

Solved Botox Facial Care had earnings after taxes of

Establishment of After Tax Cash Flow Example YouTube

Yes, the top 1 pct do pay their fair share in taxes

Why 5 Million Is Barely Enough To Retire Early With A Family

Do It Yourself Taxes Online 9 Worst Home Improvement Projects That Decrease Resale Value

![100k AfterTax By State [2023] Zippia 100k AfterTax By State [2023] Zippia](https://www.zippia.com/wp-content/uploads/2023/03/single-filer-after-tax-income.png)

100k AfterTax By State [2023] Zippia

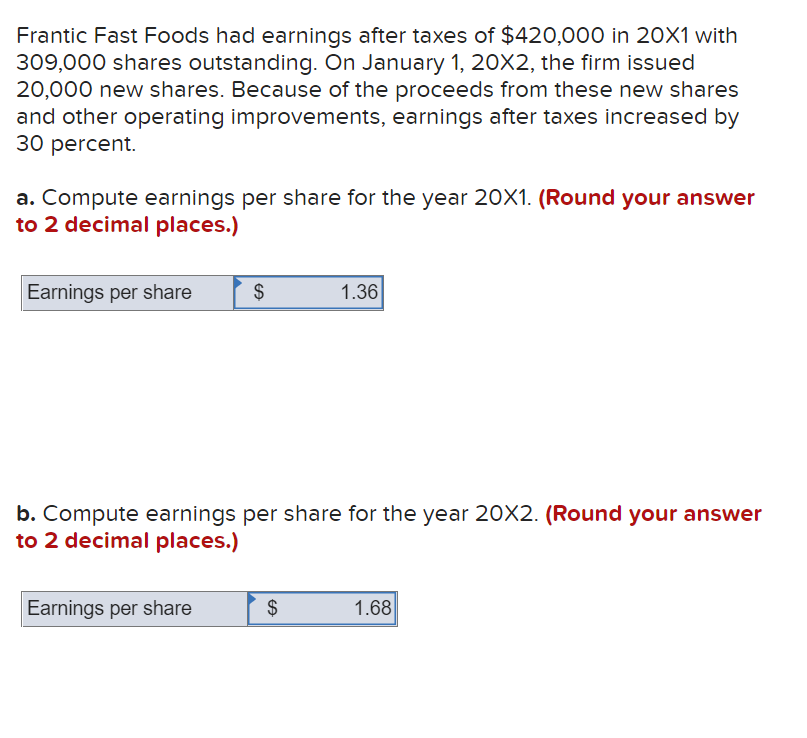

Solved Frantic Fast Foods had earnings after taxes of

Solved Taxes paid for a given level Jacques is

ABD'deki federal ve eyalet gelir vergisi oranları 2021 ve 2022

![204,000 Salary After Taxes in Wyoming (single) [2023]? Smart Personal Finance 204,000 Salary After Taxes in Wyoming (single) [2023]? Smart Personal Finance](https://smartpersonalfinance.info/wp-content/uploads/2022/09/wy-204000-after-taxes-sm-1024x768.png)

204,000 Salary After Taxes in Wyoming (single) [2023]? Smart Personal Finance

144.70. 18.09. 81.79%. Tip: Social Security and Medicare are collectively known as FICA (Federal Insurance Contributions Act). Based on this calculation your FICA payments for 2024 are $3,519.00. The California income tax calculator is designed to provide a salary example with salary deductions made in California.. What is a $4.5k after tax? $4500 Federal and State Tax Calculation by the US Salary Calculator which can be used to calculate your 2024 tax return and tax r.. Social Security Tax Due: $ 279.00: Medicare Tax Rate: 1.45%: Medicare Due: $ 65.25: State Tax Due: $ 87.00: Local Tax Due Due: $ 0.00: