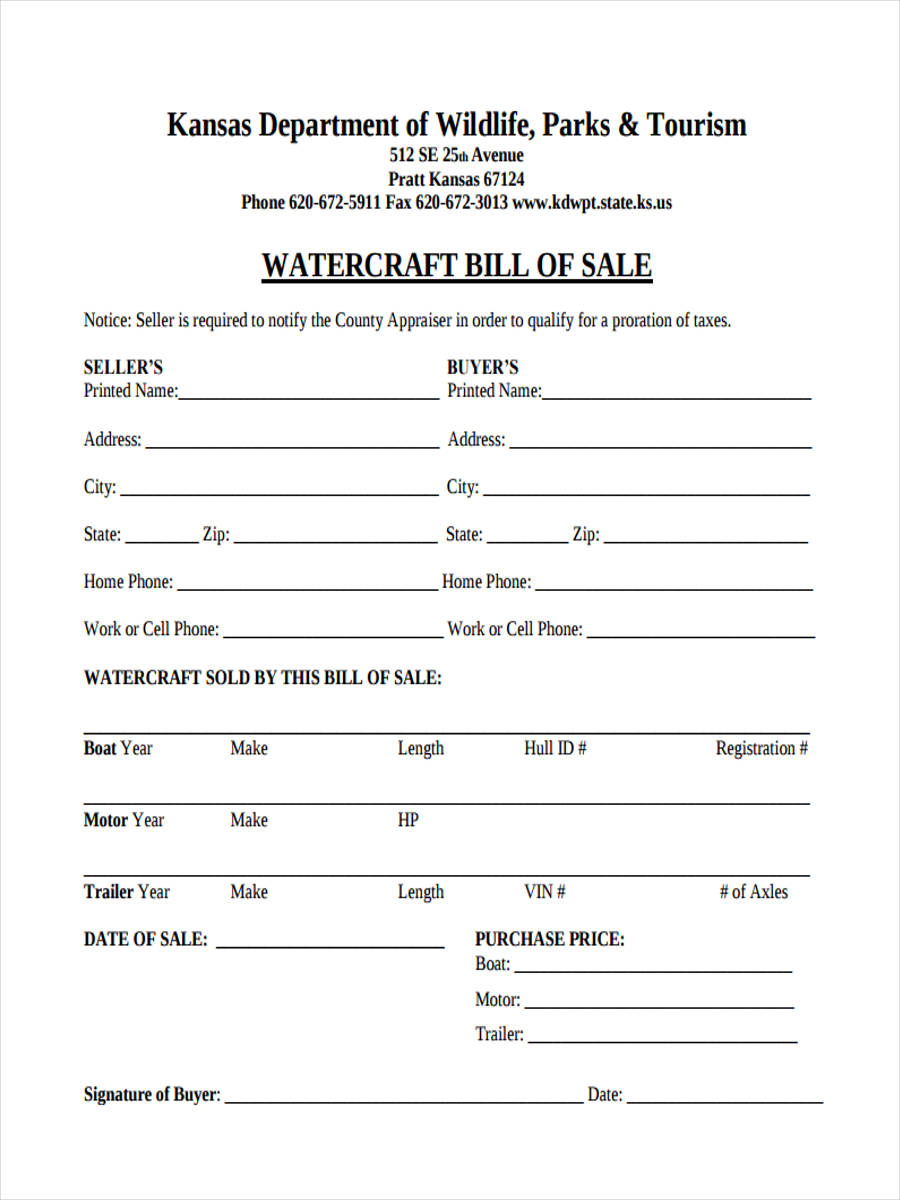

This isn't as difficult as you're thinking. Almost any motor vehicles registration office (where you go to get your drvs license and tabs) can do the whole process. As I stated before, in MN on a USED boat sale, you have to pay tax on the value of the part that is used on the road-the trailer.. One of three forms must be used to pay tax or prove that no tax is due: Form RUT-25, Use Tax Transaction Return, due no later than 30 days after the date the watercraft or snowmobile is brought into Illinois or the date of purchase from an out-of-state dealer or retailer, lending institution, or leasing company selling at retail.; Form RUT-75, Aircraft/Watercraft Use Tax Transaction Return.

Do I pay tax on Bitcoin gains? Arthur Hamilton

Do You Have To Pay Taxes If You Live On A Boat? Yacht Management South Florida

DO YOU PAY TAXES ON DIVIDENDS? An Explanation of How Dividends are Taxed YouTube

Do You Pay Sales Tax On A Leased Car Buyout? Bankrate

In 1 Chart, How Much the Rich Pay in Taxes 19FortyFive

Free Boat Trailer Bill Of Sale Form Download Pdf Word with regard to Credit Sale Agreement Te

One of the great things about property is that in some cases the that you earned can be

Do You Pay Vat On Imports? The 15 Detailed Answer

Do You Pay Tax On Salary Sacrifice Cars Fleet Evolution

TaxClaimable Expenses Annie

Do you get taxed for transferring cryptocurrency in Australia? Cointracking

Do You Pay Tax On A Property Investment (Ep154)

Do You Pay National Insurance on an Apprenticeship? Complete Apprenticeship Guide

Do You Pay Tax On Isa Withdrawal Tax Walls

Why do you pay tax? (Part 1) YouTube

Moving to the UK when do you pay tax?

Printable Boat Bill Of Sale

How much tax do you pay on your equity investment Mint

Do you Pay Tax When You Sell Your Main Residence? Ashtons Estate Agency

How much Tax do you pay for ₹100 worth of Petrol? ・ popular.pics ・ Viewer for Reddit

Sales Tax and VAT: In many countries such as the UK, there is no sales tax or VAT on the sale of used boats between two private individuals. If, however, you use a broker to sell your boat, there will be VAT on their services. In the United States there are various taxes imposed on owners when buying a boat (see our Guide to Paperwork and Taxes.. Boat owners who live in states with personal property tax laws may be required to pay an annual tax on their vessels. These taxes, as with sales and use taxes, vary between jurisdictions and are based on the assessed value of your boat. Some states offer exemptions or credits for specific types of boats, so be sure to check the laws in your area.