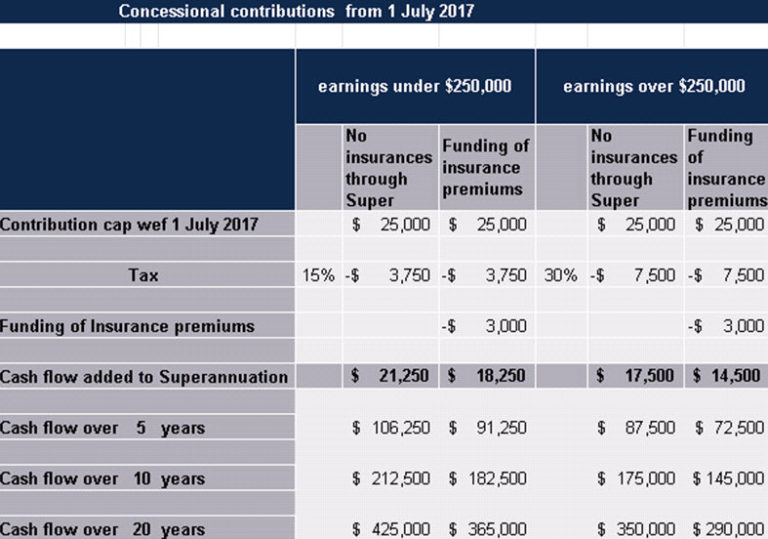

You can see a record of the concessional contributions made to your Super Savings account in Member Online. Non-concessional contribution cap From 1 July 2021, the annual non-concessional contribution cap is $110,000 a year. 'Bring-forward' rules From 1 July 2021, if you're under 75 years of age at any point during the financial year, you.. If your income and concessional super contributions total more than $250,000, check if you have to pay Division 293 tax. Super contributions to defined benefit and constitutionally protected funds Find out about caps on contributions to defined benefit funds and constitutionally protected (CPF) funds.

Australian Retirement Trust (Ausretiretrust) / Twitter

Living Comfortably in Retirement With ASAG Safely and in Control Australian Seniors News

Mobile app Why choose us? Australian Retirement Trust

Tips avoid exceeding concessional contributions cap Bilateral Solutions

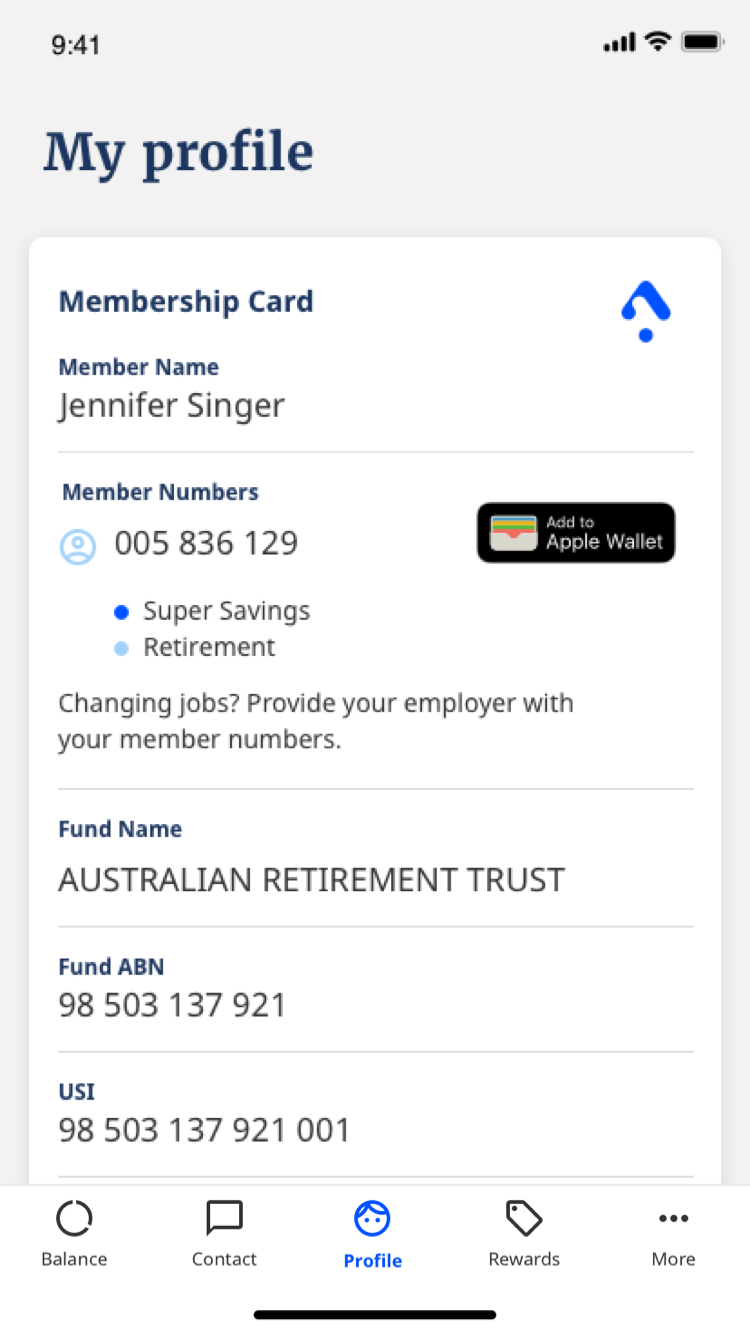

australian retirement trust abn Impressed Management

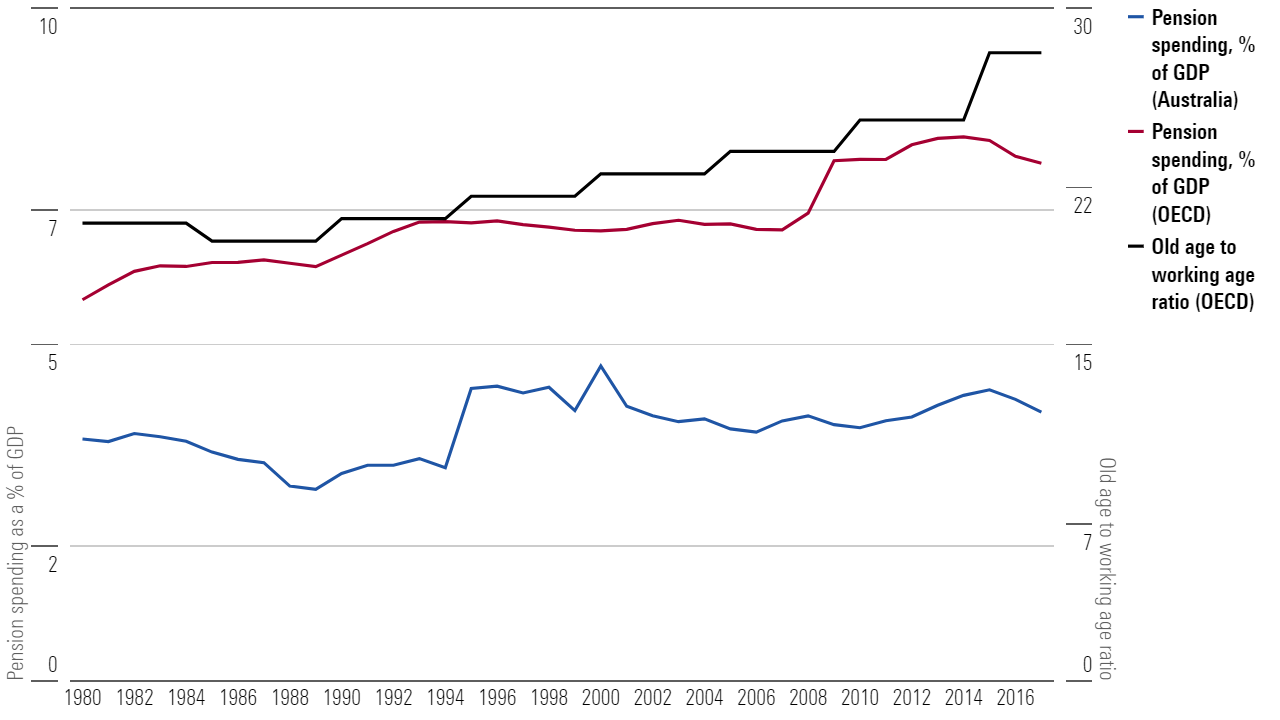

Retirement ages and pensions Charts

New rules allow you to 'carry forward' your unused Concessional Contribution Cap — Swift

Benefits of Australian Permanent Resident

Our Awards Australian Retirement Trust

Maximise Your Retirement Savings with Carry Forward Concessional Contributions MKG Partners

Australian Retirement Trust guide Performance, fees, USI, ABN

Concessional Contribution To Super Super Guarantee About Retirement

Australian Retirement Trust Super Choice Form

Retirement Stats Australia

Smarter Investing with Concessional Contributions and Nonconcessional Contributions My CMS

The australian retirement trust Early Retirement

Superannuation changes effective 1 July 2017 Concessional Contributions Horizon Wealth

Australian Retirement Trust vs AustralianSuper Review My Super

Australian Retirement Trust on LinkedIn Leading Australian Superannuation Fund ART

Australian Retirement Trust 18th Annual Australian Web Awards

One of Australia's largest super funds Australian Retirement Trust (ART) is on a mission to help Australians realise the monstrous potential of their superannuation in its latest campaign created and amplified by M&C Saatchi and Bohemia. With the nation facing some of the toughest economic. the contributions are out of your before-tax or post-tax income. you exceed the concessional or non-concessional contribution caps. you're a high-income earner. Contribution caps are the limits on how much you can pay into your super fund each financial year without having to pay extra tax. If you have more than one super fund, all your.